Why the UAE is the ultimate destination for wealthy investors – Unlock the future with property in 2026

- UAE property

- 08.01.26

- Benham and Reeves

A quiet but decisive transformation is reshaping global property investment patterns in 2026. Seasoned investors are moving capital and families looking for long-term investments are opting for options that offer security, clarity and opportunity. Amid global tax shifts, market recalibrations and uncertainties, the United Arab Emirates stands out as one of the most secure investment destinations for affluent investors and families.

The numbers are compelling. According to the latest Henley Private Wealth Migration Report 2025, the UAE is set to welcome 9,800 new millionaires, bringing over USD 63 billion in investable wealth with them. This marks the fourth consecutive year the country leads global wealth migration. And this trend shows no signs of slowing down.

What draws global investors, entrepreneurs and family offices to the UAE? Well, it isn’t a single factor, but a comprehensive ecosystem built around growth. The UAE (Dubai, Abu Dhabi and Ras Al-Khaimah) offers benefits such as:

- Political stability

- Zero annual property taxes

- A reliable USD-pegged currency

- Transparent real estate governance

- Exceptional safety

- Infrastructure built for the world’s most mobile & affluent talent

- Strategic access to Golden Visa residency pathways

Why are the wealthy flocking to the UAE?

Across major global markets, investors are facing complexities such as higher taxes, compressed yields, rising regulatory scrutiny, slower GDP growth and lifestyle uncertainties. In 2025, priorities evolved: wealth protection and personal safety are becoming as important as financial returns.

The UAE’s economy is built on these fundamentals. Beyond zero annual property tax and no capital gains tax, the country is anchored by political as well as economic stability, advanced infrastructure, seamless transport connectivity, a globally respected legal system thanks to DIFC & ADGM, lifestyle security and transparent property governance. The result is a secure destination hub where savvy investors can deploy capital with confidence and plan for the long term.

Key advantages of investing in the UAE in 2026

a. Technology & AI: Two of the UAE’s fastest-growing economic engines

In 2025, the UAE rapidly evolved into a global AI and technology superhub. The country intensively invested in the future. Independent studies are forecasting exponential growth:

- UAE’s AI market is expected to touch AED 170.1 billion by 2030, with a 44% CAGR

- Abu Dhabi is set to launch one of the world’s most advanced AI chip ecosystems

- Generative AI adoption stands at 59.4% (the highest figure globally)

- Massive fund allocations towards AI (MGX targeting AED 367 billion in AI assets)

Dubai’s accelerated fintech and digital ecosystems are rapidly attracting leading banks, hedge funds and a highly skilled workforce. These factors support strong long-term demand for residential and investment property across Dubai, Abu Dhabi and emerging markets like Ras Al-Khaimah.

b. Golden Visa: A strategic residency advantage

The UAE’s 10-year Golden Visa can easily be considered one of the most investor-friendly residency pathways worldwide. A property purchase of AED 2 million or above can:

- Unlock long-term, renewable residence for buyers

- Offer no-sponsor requirements

- Lead to unlimited re-entry in the country

- Help with family residency (spouse and children of any age)

- And comes with the ability to sponsor domestic staff

In 2025, the new Golden Visa have expanded to:

c. Safety & lifestyle security

Safety is one of the UAE’s strongest differentiators. The country continues to rank amongst the world’s safest, with an overall index of 84.5.

Abu Dhabi has been named the world’s safest city for the ninth consecutive year. Over 90% of the residents say they feel safe walking alone at night in this country. This is further reinforced by a strict regulatory framework that offers immense peace of mind for families.

d. Currency stability: AED pegged to USD since 1997

In an environment of currency fluctuations, the UAE’s long-standing USD peg offers a rare level of predictable investment returns.

For discerning Hong Kong, Malaysian and wider Asian investors already working with USD-linked portfolios, the AED peg provides a hedge against volatility in emerging market currencies.

e. A world-class business environment

The UAE’s volatility in emerging market currencies delivers unmatched ease. Company setups in many free zones can be completed within 24 hours. Additionally, 100% foreign ownership is standard. The country also ranks third on the Agility Logistics Index and the IMF projects 4.8% GDP growth in 2025. Non-oil GDP is set to expand more than 5%.

Each emirate contributes to this strength in its own way. For instance,

This diverse landscape fuels strong rental demand and long-term absorption, elements essential for property stability.

f. Education & talent ecosystems

UAE’s appeal is not limited to working professionals. With more than 77,000 overseas students enrolled across reputed institutions such as NYU Abu Dhabi, Sorbonne University, Middlesex University and Khalifa University (ranked #230 globally), this country stands as a strong education hub. This steady inflow of students and academic staff is increasing demand for well-planned residential communities, which in turn makes the city attractive for families seeking long-term stability.

Long-term property outlook: UAE in the next 5-10 years

1. Trajectory of strength

The UAE market is not only performing strongly today, but it is strategically and structurally positioned for sustained long-term growth.

- The IMF is expecting a 4-5% GDP expansion year-on-year through 2026

- Non-oil GDP is projected to touch 4.9% in 2025

- Vision 2030 aims for 80% of GDP to come from education/knowledge-based sectors

- Forecasts are also predicting 4% annual growth through 2035

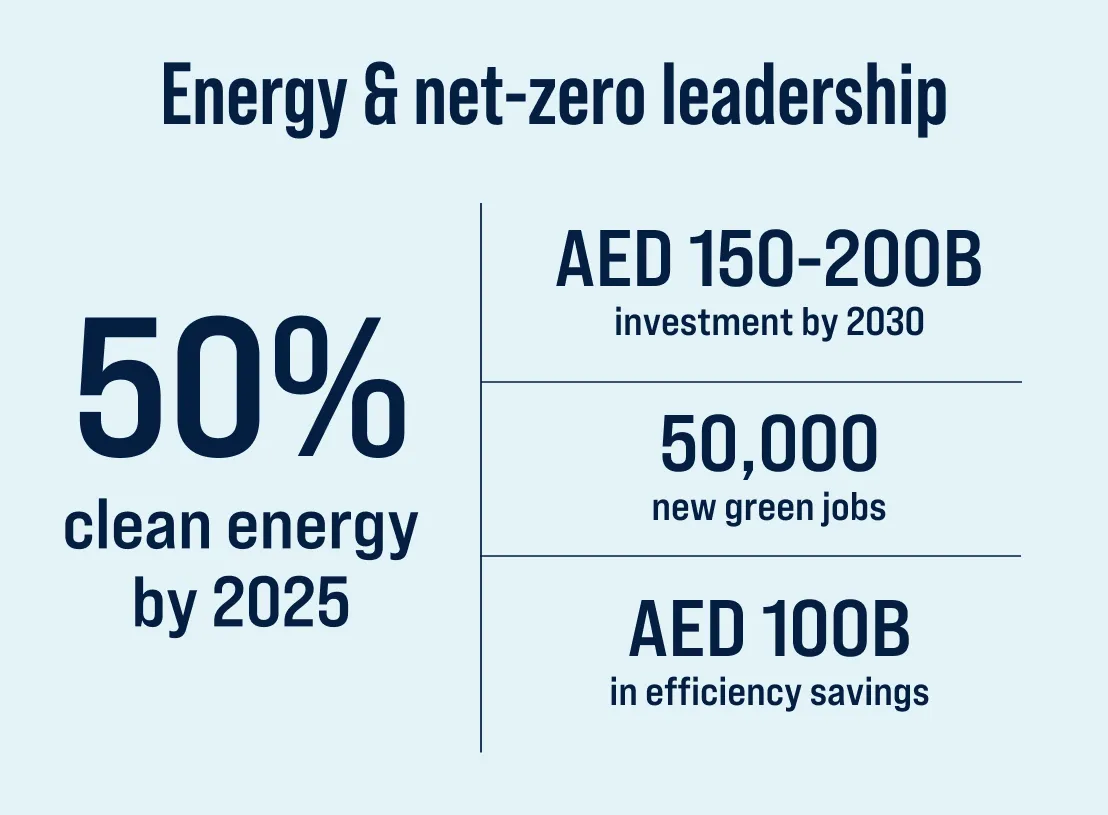

2. Energy & net-zero leadership

The UAE’s Energy Strategy 2050 targets:

- 50% clean energy by 2050

- AED 150–200B investment by 2030

- 50,000 new green jobs

- AED 100B savings from enhanced efficiency

3. UAE property market outlook and growth trends

The UAE’s residential property market was valued at USD 82.41 billion in 2024 and is expected to reach USD 132.29 billion by 2030, rising at a CAGR of 8.06%. Emirate performances vary, however:

Dubai

- Prices expected to rise 6–8% annually through 2030*

- Strongest demand in Dubai South, Downtown, Palm Jebel Ali, Business Bay, Marina

- Average rental yields stand at 6.9%*; apartments at 7.3%*

Abu Dhabi

- Saadiyat Island’s luxury villas are projected to grow 10–12% in 2025*

Ras Al-Khaimah

- The upcoming Wynn Al Marjan Island drove the nearby land’s value up by 14%*

Why does the current UAE market present a strong entry?

2025 marked a rare alignment of catalysts in the UAE market, making it a smart time to tap into the property investment side:

- Dubai’s population is projected to reach four million, driving sustained demand

- Accelerated investments are made in AI and the digital economy

- Major cultural openings like Guggenheim Abu Dhabi

- Grand announcement of Abu Dhabi Disneyland plan

- New Golden Visa categories

- Ras Al-Khaimah’s transformation into a new tourism capital

Benham and Reeves Hong Kong makes UAE property investment seamless

Established in 1995, Benham and Reeves Hong Kong is dedicated to helping Asian investors navigate overseas properties with confidence. With multilingual experts fluent in Cantonese, Mandarin, English and Tagalog, the team offers tailored advice for Hong Kong and Asian buyers exploring Dubai.

We have 21 offices in London and over 14 global branches, including a well-established presence in the UAE. Our experienced, multilingual team of UAE agents offers real-time insights, deep expertise in Dubai, Abu Dhabi & RAK property markets. The team will also help with referrals for vetted lawyers, mortgage brokers and financial institutions.

Benham and Reeves connects Hong Kong buyers to the UAE market seamlessly and offers a curated portfolio from the UAE’s most trusted developers, including Emaar, Sobha, DAMAC, Binghatti, Aldar, Meraas, Nakheel, Dar Global, Ellington, etc.

Our services also extend to legal documentation, payment schedules and remote transactions.

Whether you’d like to explore Dubai’s dynamic skyline, Abu Dhabi’s cultural enclaves or Ras Al-Khaimah’s emerging island destinations, the progress made across the UAE in 2025 has laid a strong foundation for the years ahead. As the market enters 2026, conditions point towards a narrowing window for early entry, making this an important moment for investors to act without waiting on the sidelines.

Now is your moment to secure a part of it. Get in touch with us today to know more.

Disclaimer: To buy or not to buy non-local off-plan properties? Assess the risks before you buy! 境外樓花買唔買?計過風險先好買!*Expected return, not guaranteed. Purchasing uncompleted properties situated outside Hong Kong is complicated and contains risk. You should review all relevant information and documents carefully before making a purchase decision. If in doubt, please seek independent professional advice before making a purchase decision. The non-licensed staff engage in estate agency work exclusively in relation to properties outside Hong Kong and they are not licensed to deal with any property situated in Hong Kong. Advertisement Date: 8 Jan 2026. Benham & Reeves (Hong Kong) Limited License No. C-092169.

About the Author

With over 60 years of experience in London market, Benham and Reeves offers a comprehensive one-stop service which includes London property sales (purchase and selling) and full letting and management services to investors. Benham and Reeves Hong Kong SAR office was established in 1995 to provide real estate agency services to Hong Kong buyers, sellers and landlords in regards to all their London property needs.View all posts by Benham and Reeves