The impact of crossrail on London’s property market: A transformational journey

- Property market updates

- 01.11.23

- Benham and Reeves

The Crossrail project, also known as the Elizabeth Line, is rapidly transforming transportation in London. This railway line, stretching from Reading and Heathrow to Shenfield and Abbey Wood, has reduced journey times, alleviated crowding on existing networks and expanded journey options for commuters.

It also plays a vital role in connecting key areas of the city, including the City of London, Canary Wharf, the West End and Heathrow Airport. For instance, a journey from Heathrow Airport to the City of London takes just 20 minutes on the Elizabeth Line. This is compared to 45 minutes on the Piccadilly line or 1 hour by car.

To understand the immense scope of this project, let’s take a closer look at the details. This transformative initiative has the city government invested an astounding £18.8 billion – resulting in an extensive network of 40 strategically located Crossrail stations. This includes eight innovative subsurface stations and two contemporary above-ground stations.

A remarkable 42 kilometres of new tunnels have been constructed, enabling fast and efficient travel. The introduction of cutting-edge 200-meter-long trains exemplifies the project’s dedication to modernising transportation in London. Additionally, the project goes beyond the tracks, encompassing 40 improvements to public spaces across London, showcasing the government’s comprehensive and integrated approach to urban development.

Reduced travel times

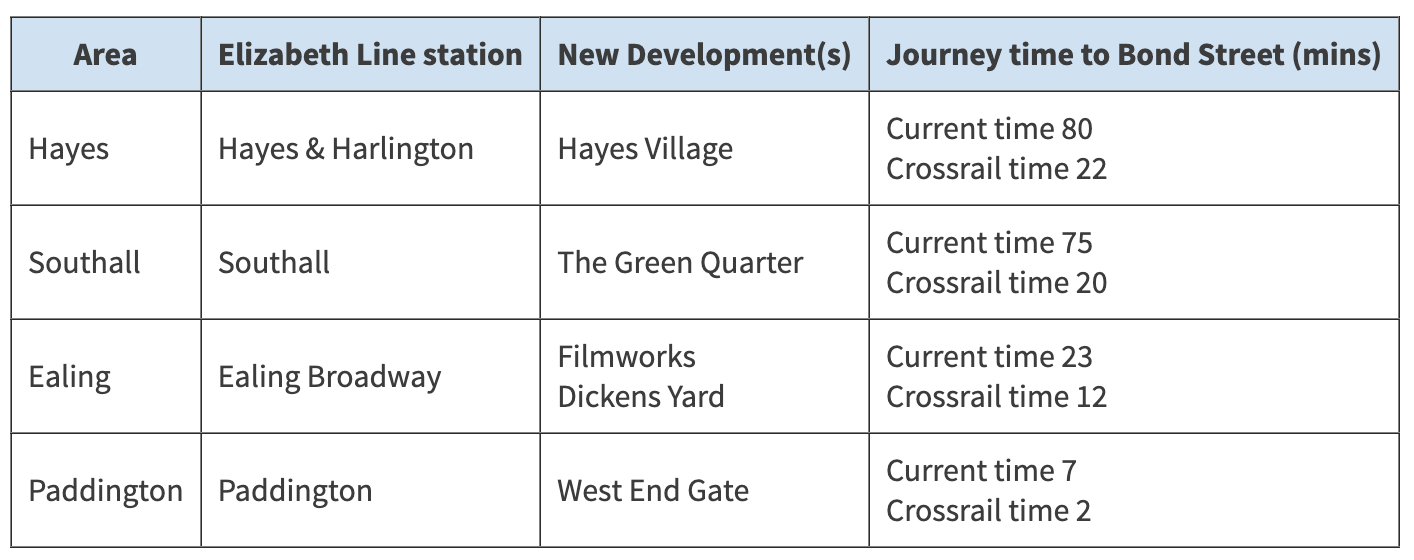

The Elizabeth Line, or Crossrail, has revolutionised travel times in London, reducing travel times drastically. For instance:

– Journey from Abbey Wood to Canary Wharf reduced from 33 minutes to 11 minutes, without needing any changes

– Travel duration between Abbey Wood and Tottenham Court Road was slashed by about 28 minutes, making it a 23-minute direct commute, down from a previously convoluted hour-long trip with multiple changes

– Commute from Farringdon to Canary Wharf shortened from 24 minutes and three Tube trains to a quick 10-minute ride on a single Elizabeth Line train

– Travel time from Whitechapel to Tottenham Court Road decreased from up to 20 minutes with at least one Tube change to just 8 minutes on the Elizabeth Line, eliminating the need for transfers

– Journey from Liverpool Street to Paddington reduced from nearly 20 minutes to a direct 10-minute trip, enhancing efficiency for commuters

This enhanced connectivity benefits daily commuters and travellers alike, streamlining London’s transportation system and making it more user-friendly. The integration of the central section of the Elizabeth Line with the east and west sections enhances these advantages further, providing even faster travel times.

For example, a student who lives in Reading can now travel to their university in central London in just 20 minutes via the Elizabeth line. This means that they can spend more time studying and less time commuting. A worker in Canary Wharf can now travel to their office in the City of London in just 10 minutes on the Elizabeth line.

Beyond domestic boundaries

Elizabeth Line doesn’t just revolutionise domestic travel; it also significantly enhances international commutes. Business flyers can now reach international destinations like Singapore or Dubai within 30 minutes of leaving a meeting in Canary Wharf. This international accessibility augments the attractiveness of the areas around Elizabeth Line stations to a global audience.

Transforming London’s property market

Crossrail’s impact is not limited to transportation alone! This tremendous railway is like a stone thrown into a pond, creating ripples far beyond. In this case, these ripples are transforming London’s property market—changing property prices, affecting demand and influencing development plans.

Quicker travel times and a more comprehensive transport network are already altering property investors’ views and value properties in the areas served by this ambitious railway.

Boosting property prices along the Elizabeth line

When the Elizabeth Line was first announced in 2008, it generated considerable excitement and anticipation. Estate agents and property developers were also particularly interested, recognising its transformative potential for property prices in the areas it would traverse.

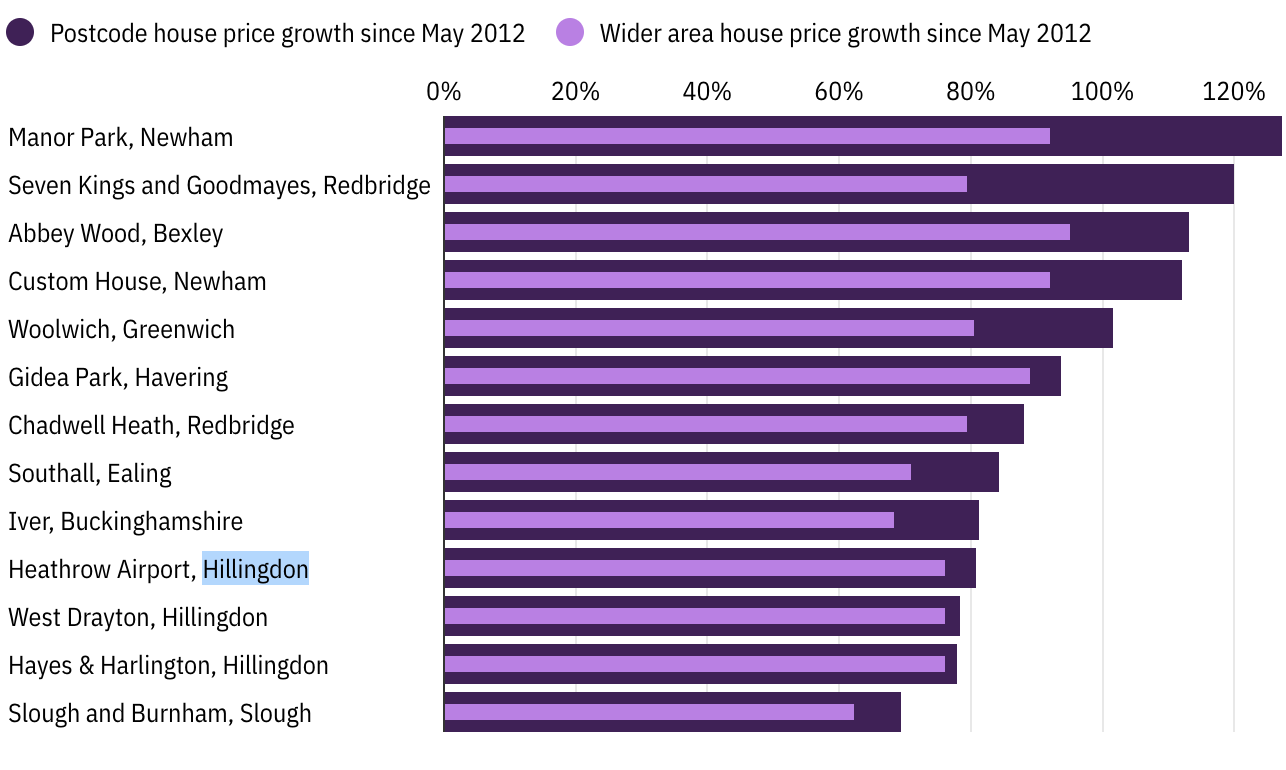

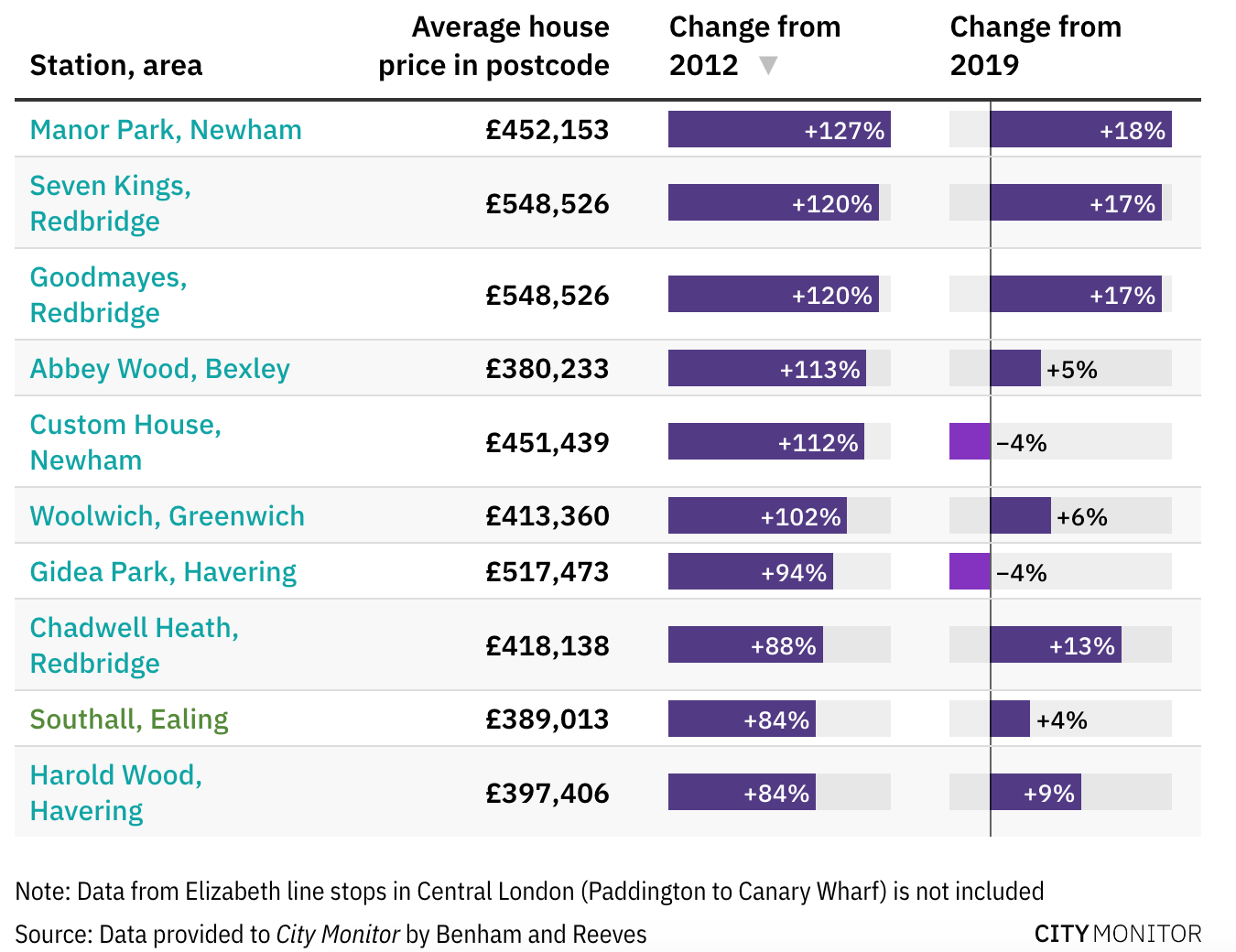

Once it became operational in 2012, the railway line’s impact on the property market became evident through a remarkable surge in average house prices. An in-depth analysis of property data conducted by Benham and Reeves across the 41 stations of the Elizabeth Line showcased a significant increase of 70%.

This surge in property prices surpassed the national average increase of 65%, underlining the railway line’s profound influence on the property market. Notably, central London station postcodes witnessed an even more astonishing rise – with house prices spiking by an impressive 73%. This indicated how this new transportation network had the power to shape property values in the city’s heart.

Recent trends

In the past two years, the four inner west stations, from Acton Main Line to Hanwell, have seen the most significant price growth, with average house prices around these stations increasing by 12%. This surge is attributed to pandemic buyers flocking to these leafy suburban areas, seeking solace and space.

Emerging hotspots

– Reading: Located west of London, Reading is emerging as a Crossrail hotspot. This town benefits from improved connectivity, with direct links to central London and beyond. This accessibility appeals to professionals and commuters seeking the advantage of efficient travel.

– Canary Wharf: Canary Wharf is another significant financial hub in London experiencing a surge in prominence due to the influence of Crossrail. The area is known for its modern and sleek architecture, offering luxurious apartments with stunning waterfront views. Professionals in finance and business find Canary Wharf exceptionally attractive due to its strategic location and enhanced transportation facilitated by Crossrail.

– The West End: London’s vibrant West End, renowned for its cultural richness, is further enlivened by Crossrail’s advent. The area is a hub for arts, theatres and cultural experiences, making it highly appealing to art enthusiasts and tourists alike. With the improved connectivity brought about by Crossrail, accessibility to this cultural haven is significantly enhanced.

– Heathrow Airport: Heathrow Airport, one of the world’s busiest international airports, is set to become an even more prominent hub with the influence of Crossrail. The direct connection provided by Crossrail ensures quick and efficient travel to and from Heathrow, making it an attractive location for those who frequently travel internationally for business or leisure.

– City of London: The historical and financial epicentre of London, the City of London, is witnessing a resurgence in appeal due to the transformative impact of Crossrail. Professionals in the finance and legal sectors find the area incredibly enticing, given its proximity to major financial institutions and law firms.

Standout performers

Over the past decade, Manor Park in Newham has seen house prices more than double. Similarly, Redbridge’s Seven Kings and Goodmayes stations have also experienced a staggering 120% increase in house prices during the same period. These standout performers underline the transformative effect of the Elizabeth Line on previously undervalued areas.

Royal Arsenal Riverside, Woolwich

Situated in Woolwich, southeast London, the Royal Arsenal Riverside is transforming remarkably into one of the UK’s largest and most ambitious regeneration projects. Formerly a munitions site, it is now a bustling community featuring numerous homes, businesses and amenities.

Crossrail has played a pivotal role in propelling this regeneration effort. The unveiling of the new Woolwich Crossrail station in December 2019 proved to be a game-changer, offering direct access to Canary Wharf within a mere 7 minutes and Liverpool Street within 15 minutes. These travel times even outpace some Zones 2 and 3 locations, rendering Royal Arsenal Riverside an immensely appealing place to reside and work.

Moreover, the Crossrail station acted as a catalyst for a wave of new developments in the area. Over recent years, several residential and commercial buildings have been completed, with many more exciting projects in the pipeline. The region also witnesses a burgeoning array of restaurants, bars and shops.

London rental market

In 2022, with the launch of the Elizabeth Line, residential areas along its route have emerged as highly sought-after rental destinations. The demand for new developments like Dickens Yard Ealing and The Green Quarter Southall, situated in the western part of London and Royal Arsenal Riverside in Woolwich, South East London, has experienced remarkable growth.

The rental market in London is currently experiencing a significant surge, which is anticipated to persist. The average rents in Prime London surged by 28.3% in the year leading up to May 2022.

Properties near Elizabeth Line stations also witness a similar upward price trend. For instance, rents in Slough have spiked by 44%, bringing them to around £1,424 per month. Southall has emerged as another significant beneficiary of this rental boom. The number of agency inquiries regarding lettings in the area shot up by an impressive 372% compared to a decade ago.

The opening of Crossrail has significantly expanded the potential for rental income and property management services in areas linked by this transformative railway network.

Read more on: How landlords can expertly maintain London rental property from Hong Kong

A wise financial decision

The enhanced connectivity and reduced travel times offered by Crossrail make areas along its route highly attractive to renters. Professionals seeking convenient access to major employment hubs like Canary Wharf and Liverpool Street are likelier to opt for properties with seamless transportation options. This surge in demand can translate into a steady stream of rental income for domestic and overseas property investors.

Diverse tenant pool

Crossrail’s reach encompasses various neighbourhoods, catering to a diverse range of potential tenants – from working professionals to students and even tourists. This diversity allows property investors to tailor their properties to specific target demographics, potentially maximising rental yields and occupancy rates.

Property management companies like London’s renowned Benham & Reeves play a vital role in helping landlords to take advantage of these opportunities. By providing a range of services, such as tenant finding, rent collection and property maintenance, Benham & Reeves freed up landlords‘ time over the course of 60 years and allowed them to focus on other aspects of their business.

Crossrail: Bridging the housing gap for students

The transformative Elizabeth Line has effectively bridged the housing gap for students in London. Traditionally, living farther from Central London was seen as a means to secure more affordable housing and lower living costs. However, this often came at the expense of longer commute times and limited accessibility to educational institutions in the city centre.

With the advent of Crossrail, these suburban and peripheral areas have become easily accessible without compromising on proximity to universities, colleges and libraries in Central London. The enhanced connectivity provided by Crossrail has effectively diminished the distance barrier, making these regions highly appealing to students on a budget.

With the advent of Crossrail, the property investment landscape in London has witnessed a notable transformation. Properties in the outer zones from Zone 3 onwards offer tenants more affordable pricing than central areas. The increased demand due to better connectivity provides a potential for property appreciation, making it an attractive option for Hong Kong investors seeking a balance between affordability and future returns.

Investment tips & considerations for Hong Kong investors

For Hong Kong citizens considering property investment in London, keeping a few key factors in mind is crucial. Firstly, research extensively on areas along the Elizabeth Line, as these have emerged as prime rental hotspots. Locations like Dickens Yard Ealing, The Green Quarter Southall and Royal Arsenal Riverside in Woolwich have shown exceptional demand.

Including properties in the outer zones as part of an investment portfolio can serve as a diversification strategy. By spreading investments across different zones, investors can mitigate risks and capitalise on varied market dynamics and demands.

Consider legal and financial aspects, including taxation and currency exchange rates. Consulting with local experts and financial advisors can provide valuable insights tailored to your situation. Hong Kong investors can also contact the local Benham and Reeves agents in Hong Kong, who can help them navigate the London property market.

Growth possibilities for Hong Kong investors

For Hong Kong investors, Crossrail opens up a world of potential in London’s property market. The enhanced connectivity makes areas along the Elizabeth Line attractive for tenants and buyers. This increased demand can lead to significant appreciation in property values over time, presenting a promising opportunity for long-term investment.

However, thorough research, expert advice and a keen understanding of legal and financial considerations are essential for making informed investment decisions. We believe Hong Kong investors can benefit from contacting their local Benham and Reeves agents, who have specialised knowledge and experience in navigating the London property market over more than 60 years.

About the Author

With over 60 years of experience in London market, Benham and Reeves offers a comprehensive one-stop service which includes London property sales (purchase and selling) and full letting and management services to investors. Benham and Reeves Hong Kong SAR office was established in 1995 to provide real estate agency services to Hong Kong buyers, sellers and landlords in regards to all their London property needs.View all posts by Benham and Reeves