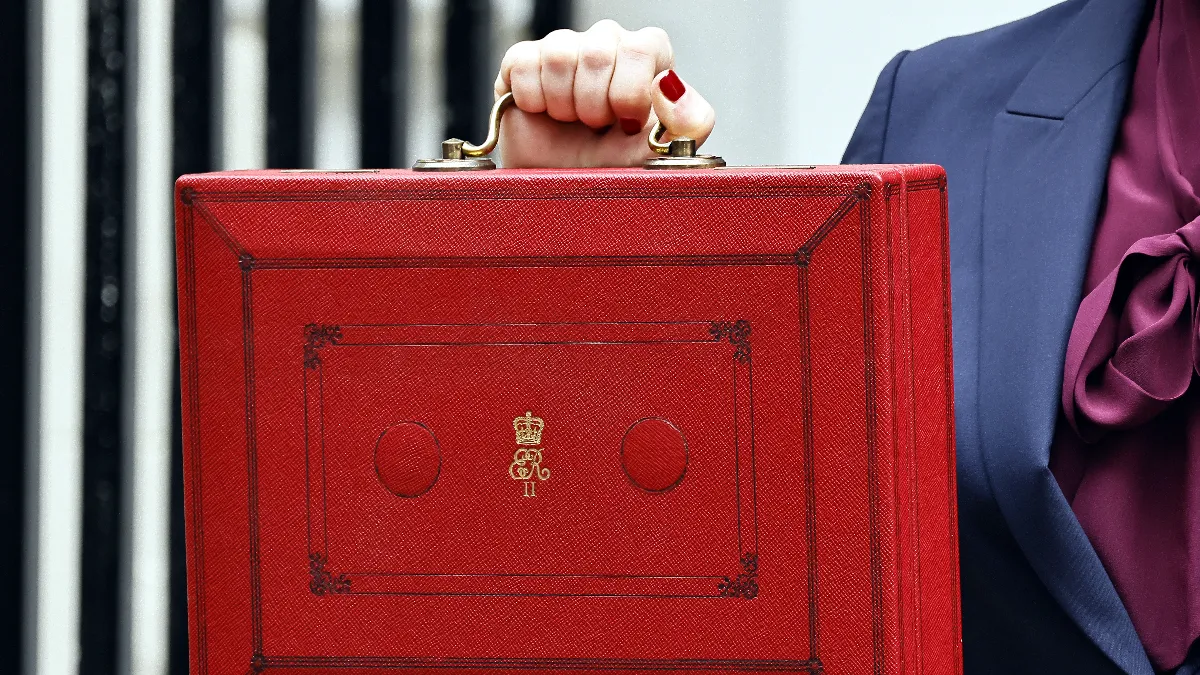

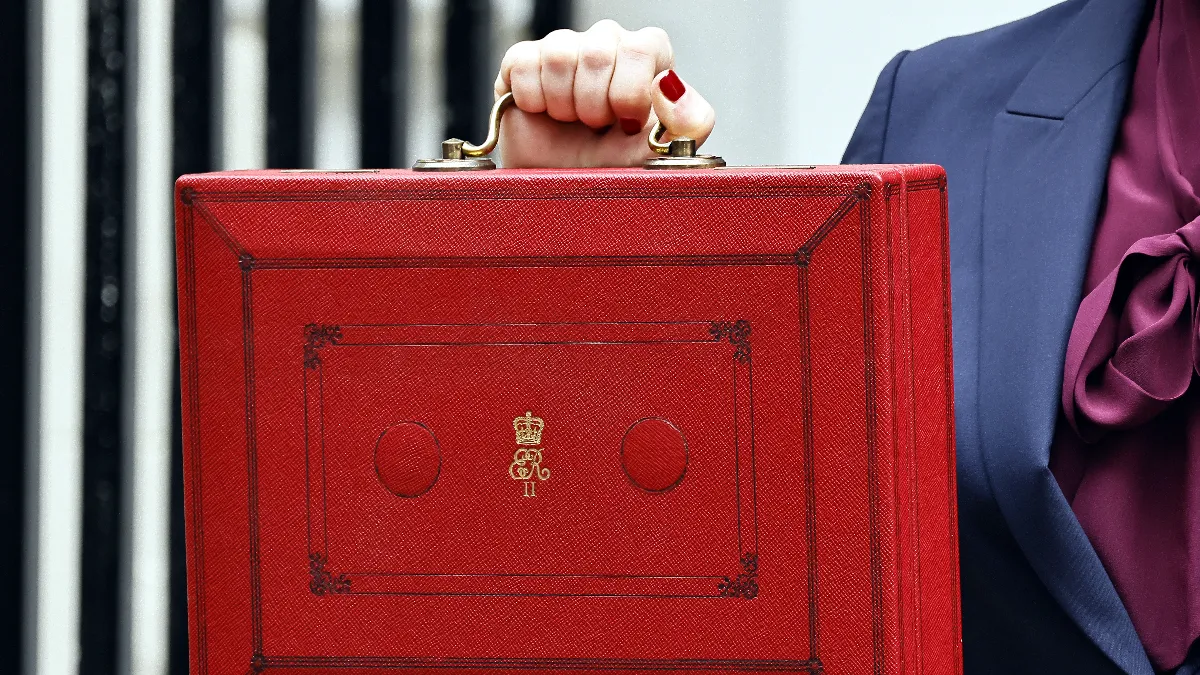

Investors who own property in the UK, including those from Hong Kong, are all asking the same thing: What will the UK Autumn Budget 2025 mean for me?

Under the new leadership at the Treasury and fiscal tightening, this Budget, expected on 26 November 2025, will reshape how overseas investors approach London property investment.

Benham and Reeves Hong Kong have guided thousands of landlords through every policy cycle since our Hong Kong SAR office opened in 1995. The key behind our success in this region is anticipating what’s next, not reacting to it.

Why the UK Autumn Budget matters

Currently, the UK is dealing with a fiscal gap of approximately £40–50 billion. Raising revenue through tax changes appears inevitable. For Hong Kong investors, this could mean adjustments in:

- Capital Gains Tax (CGT) on property sales

- National Insurance (NI) on rental income

- Stamp Duty Land Tax (SDLT) thresholds

- Property & Wealth Taxes, including Mansion Tax

2024 vs 2025: What has changed?

Last year’s Budget focused on foundational repairs. 2024’s Budget was all about stabilising public finances, boosting wages and investing in infrastructure. Its impact hiked CGT (Capital Gains Taxes), froze fuel duty and abolished non-dom status.

While last year’s budget kept income tax and VAT rates stable, the 2025 Budget is all about fiscal balancing.

As a Hong Kong property buyer in London, you can expect to see changes in the income tax threshold, IHT tightening and a possible Mansion Tax reform.

Expected Capital Gains Tax under the new Budget

Analysts are expecting potential alignment of the Capital Gains Tax with income tax bands. This may influence several Hong Kong investors considering selling their UK property.

Our advice for discerning landlords?

Strategic timing or reinvestment into new homes in London that offer growth potential can help ease this new policy’s impact and strengthen rental yields & capital appreciation.

National Insurance on rental income

Extending National Insurance to rental earnings is currently under discussion. Landlords who are earning above £50,000 can face a considerable contribution, slightly reducing yields.

Despite this, several Benham and Reeves Hong Kong clients are operating efficiently thanks to their professionally managed portfolios across London.

Stamp Duty 2025: Could buying London property become easier?

Changes to Stamp Duty (SDLT) are expected that will help boost the market. If thresholds are lowered, Hong Kong buyers can take advantage of this, especially in regeneration areas like Wembley Park, Tooting and Woolwich, Zone 3-4, which offer solid transportation options, consistent rental demand and better property value.

Will the new Property & Wealth Taxes include a Mansion Tax?

Media speculation indicates potential reforms or replacements of the existing Council Tax system. This includes the possibility of the introduction of property-value-based tax. The Institute for Fiscal Studies (IFS) suggests increasing rates on higher-value properties to make the tax less regressive.

Council Tax Rates are expected to rise 4.3% annually for the rest of the Parliament. In addition to this, discussions around reintroducing the Mansion Tax are ongoing, which could lead to a 1% levy on properties above £2 million.

Inheritance Tax (IHT) reforms

Building on 2024’s Budget reforms, the UK Government this year is focusing on inheritance and wealth transfers. Under this, new policies can include a lifetime gifting limit of possibly £100,000 before death. The taper relief or the gradual reduction in tax might also be stretched over 10 years instead of the current seven-year period.

Summary of key 2025 Budget expectations & impact

| Segment |

Possible Change in Budget 2025 |

Impact for Hong Kong Investors |

| Income Tax |

Possibility of 2p increase in Income Tax. National Income can be extended to landlords and older workers. |

May lead to higher tax bills, lower net yields and require prompt portfolio restructuring. |

| Inheritance Tax or IHT |

A lifetime gifting cap would be increased to £100k. In addition to this, taper relief changes can be extended up to ten years. |

Wider IHT exposure expected for cross-generational UK asset transfers. |

| Property & Wealth Taxes |

Mansion Tax can be 1% above £2 million. |

This may mean higher annual holding costs for those who own prime London assets. |

| Stamp Duty Land Tax (SDLT) |

SDLT may undergo threshold changes. |

New SDLT reforms may mean easier entry for buyers and reduced friction in mid-market segments. |

| Capital Gains Tax (CGT) |

Discussions are underway for potential CGT alignment with income tax rates. |

If approved, this will mean reduced post-sale gains and may encourage long-term holds. |

UK Budget 2025: Frequently asked questions for Hong Kong investors

1. Should I wait until after the Budget to buy?

Not if your outlook is long-term. In most cases, entry time matters the most than selecting the right asset in an upcoming or regenerating area.

2. Will property prices in London fall if taxes rise?

History is witness that London’s fundamentals stand strong against modest policy shifts. Limited supply and high demand will keep values stable across the capital.

3. How can I protect my rental income in the UK?

With professional management, proactive rent reviews and in-house lettings, you can. Benham and Reeves Hong Kong is a call away and experienced to assist you with all of this and beyond.

4. Is London still worth investing in 2025?

Despite changing tax rules, London property investment continues to stand on strong fundamentals. The city’s continuous housing shortage, consistent rental demand and rock-solid reputation make it the leading choice for global investors.

Since 1995, Benham and Reeves Hong Kong SAR has offered thousands of investors assistance with sales, letting and management, with seamless coordination between Asia and our 21 London branches.

Final thoughts: Plan, don’t pause

At Benham and Reeves Hong Kong SAR, our role goes much beyond property transactions. We offer assistance to our clientele through every policy shift, anticipate its impact and act at the right time with confidence. Whether it is restructuring a portfolio, revaluing assets or identifying new homes in London that align best with your long-term goals, our agents can handle it all.

Backed with real-time insights from our 21 London branches and a multilingual Hong Kong team that understands both markets, we ensure your investments stand strong through every economic cycle.

Get in touch with our office and schedule a free, no-obligation consultation today.